Market Commentary | December 2nd, 2024

Week in Review…

With markets closed on Thursday for the holiday and an early closure on Friday, the market still demonstrated positive momentum across the major indices:

- The S&P 500 rose +1.06%

- The Dow Jones Industrial Average was up +1.39%

- The tech-heavy Nasdaq finished up +0.74%

- The 10-Year Treasury yield ended the week at 4.178%

Housing Market Update: A Mixed Bag

Last week’s headlines were dominated by disappointing new home sales figures. Sales came in significantly below expectations, particularly in the South, likely impacted by hurricanes. However, building permits showed some strength, suggesting builders may be optimistic about future demand.

Interest Rate Dynamics

The U.S. Treasury auctioned 2-, 5-, and 7-year notes last week. Short-term yields rose, particularly the 2-year note, potentially signaling expectations of higher Fed Funds rates. In contrast, long-term rates declined, leading to a drop in 30-year mortgage rates. Markets are navigating a challenging environment with elevated short-term (gross domestic product) GDP and inflation. While the market anticipates the Fed will eventually achieve its 2% inflation target, the path to getting there may be less straightforward.

Inflation and GDP

Both core (personal consumption expenditures) PCE inflation and Q3 GDP were in line with expectations. While GDP remains strong, inflation persists at around 3%. This mixed picture highlights the challenge of balancing economic growth with price stability. Both GDP and inflation are key inputs for bond yield and market return forecasts. Strong GDP and persistent inflation at around 3% will challenge these forecasts.

Spotlight

Implications of the Upcoming Trade War in 2025

As we approach 2025, the prospect of a new trade war looms large, with significant implications for global markets and economies. Drawing insights from recent analyses by Charles Schwab and the International Monetary Fund (IMF), we can better understand the potential impacts and prepare for the challenges ahead.

Historically, trade wars have introduced volatility into the stock market. According to Charles Schwab, while the initial announcements of tariffs and trade restrictions often lead to sharp selloffs, markets tend to stabilize as the specifics of the trade policies become clearer. For instance, during the U.S.-China trade war, the S&P 500 experienced significant fluctuations, but eventually recovered as investors adjusted to the new trade environment.

The IMF’s World Economic Outlook highlights that the global growth outlook remains stable yet underwhelming, with growth projections for 2024 and 2025 at around 3.2%. However, the balance of risks is tilted to the downside, with rising protectionism and trade tensions posing significant threats.

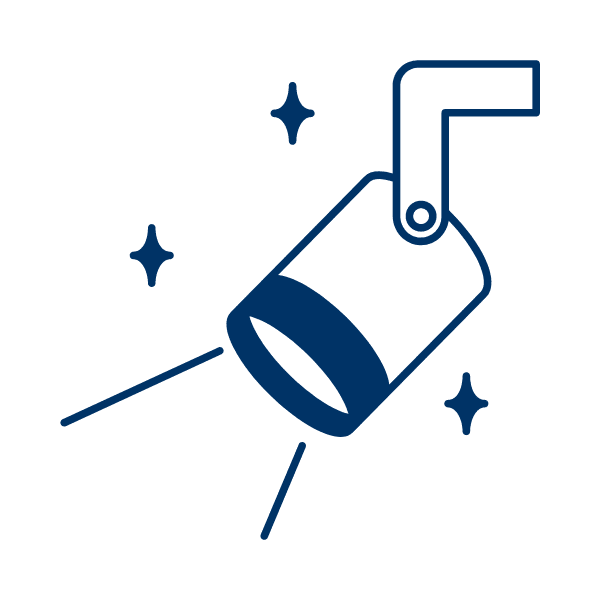

Recent Inflation Developments

The proposed tariffs could have varied impacts across various sectors and regions, while different sectors will likely experience various impacts from the trade war. Industries heavily reliant on international supply chains, such as technology and manufacturing, may face increased costs and disruptions. Conversely, sectors less exposed to international trade, like utilities and consumer staples, might be more resilient. The IMF notes that sectors with high foreign sales exposure could see more pronounced effects, necessitating strategic adjustments by companies. Tariffs can lead to higher costs for imported goods, which may be passed on to consumers, potentially driving inflation. This inflationary pressure can squeeze corporate profit margins, particularly for companies that cannot easily pass on these costs. The IMF’s analysis suggests that while the overall impact on inflation might be contained, certain industries could see significant cost increases, affecting their earnings.

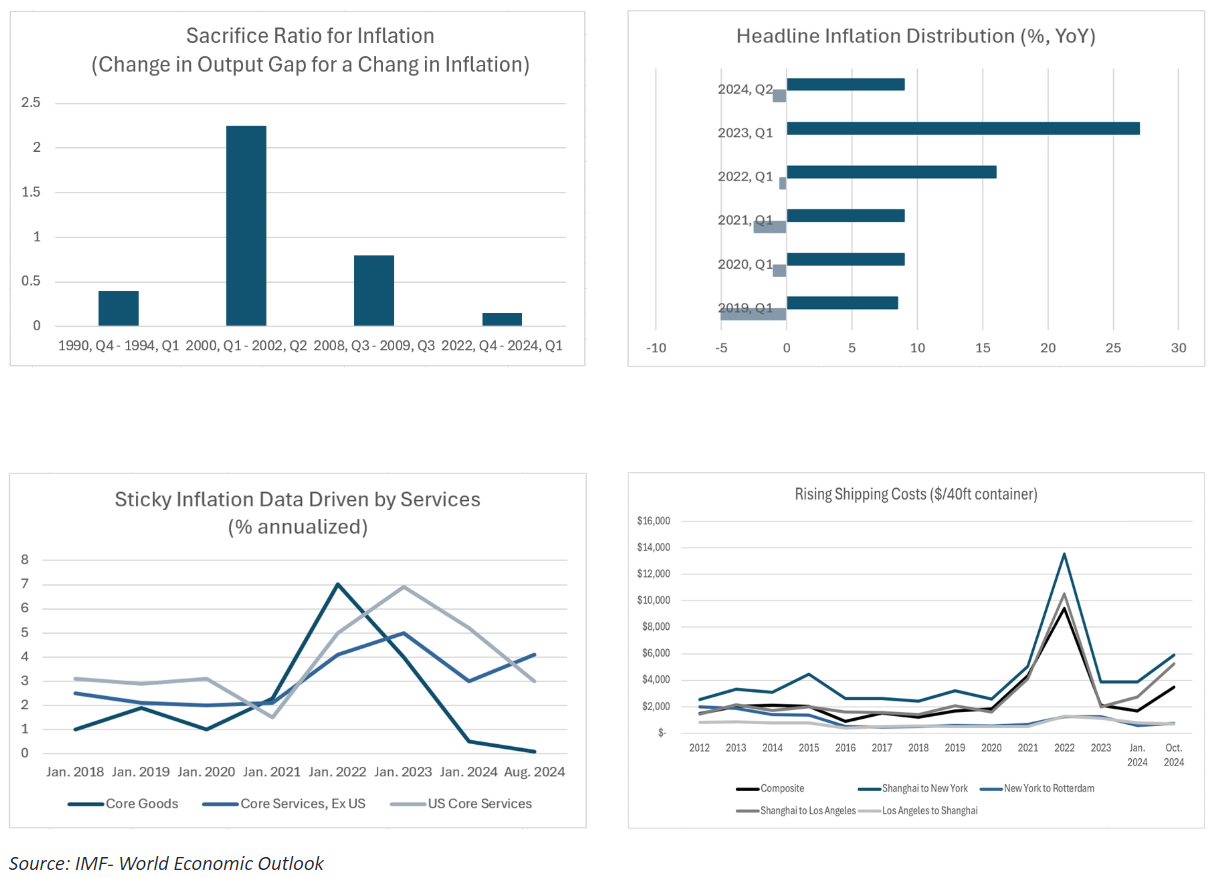

In the long term, markets often adapt to new trade realities. Companies may shift their supply chains, seek new markets, or innovate to mitigate the impact of tariffs. Historical data shows that despite initial disruptions, stock markets have shown resilience and the ability to recover over time. For example, during past trade tensions, firms with high international sales performed similarly to those with minimal foreign sales, indicating a capacity for adaptation.

MSCI World Constituents Performed Similar Despite Foreign Sales Exposure

To navigate the uncertainties of a trade war, investors should consider diversifying their portfolios and focusing on sectors less affected by international trade. On the other hand, the IMF emphasizes the need for a policy pivot to address the rising threats posed by trade tensions, which includes shifting gears on fiscal policy to ensure sustainable debt dynamics and rebuilding fiscal buffers to mitigate the adverse effects of trade tensions.

While the upcoming trade war in 2025 presents significant risks, understanding these potential impacts and preparing strategic responses can help investors and policymakers navigate and adapt to the challenges ahead.

Week Ahead…

The market will be active over the next week, with labor reports and economic sentiment indexes taking center stage. Investors will closely watch these key indicators for clues about the economy’s trajectory and potential year-end market volatility.

Labor Market Focus

The week provides an opportunity to assess the overall health of the job market. Jobs data has become increasingly important as the Federal Reserve resumes its dual mandate.

- Tuesday’s Job Openings and Labor Turnover Survey (JOLTS) report will provide insights into labor demand and, by extension, economic demand

- On Friday, the nonfarm payrolls report will be crucial, especially after October’s figures were skewed by hurricanes. Markets will closely watch this report.

- Also on Friday, the unemployment rate will be released. It has remained at 4.1% for the past two reports, and a significant increase would be unwelcome.

- Weekly jobless claims will continue to provide additional information about the job market

Markets will watch these reports closely as a strong job market could discourage the Fed from cutting interest rates.

Economic Sentiment Indexes

A couple of important market sentiment indexes will be released this week:

- Monday’s ISM Manufacturing Purchasing Managers’ Index (PMI) will gauge whether the manufacturing sector will continue to drag on economic activity or start to participate in the upside

- Wednesday’s ISM Non-Manufacturing PMI will be more important as economic activity is driven more by consumption and non-manufacturing sectors. The last three reports have beaten expectations, and markets hope this trend continues.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.